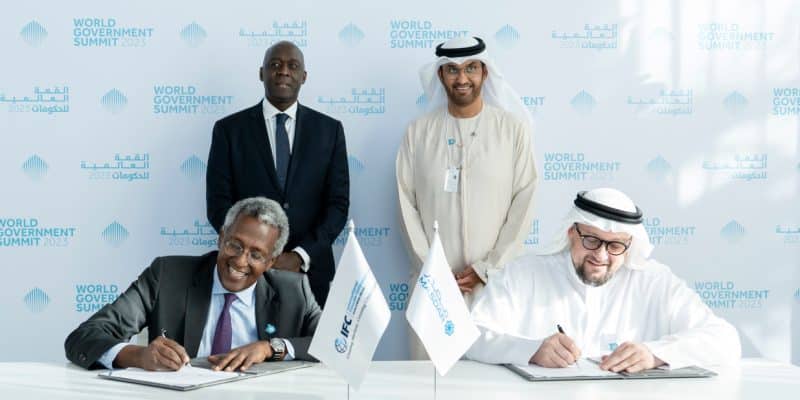

The Emirati energy company Masdar has just signed a partnership with the International Finance Corporation (IFC), the subsidiary of the World Bank Group in charge of financing the private sector. The aim is to invest in renewable energies and the emerging green hydrogen sector in developing countries, particularly in Africa.

Masdar has a strong ally for the development of its activities in developing countries. It is the International Finance Corporation (IFC). The subsidiary of the World Bank Group in charge of financing the private sector should accompany Masdar, which wants to invest massively in renewable energies and the nascent green hydrogen sector in Africa.

At the Abu Dhabi Sustainable Development Week, which ended in January 2023, Masdar, also known as Abu Dhabi Future Energy Company, committed to developing 5,000 MW of installed solar power capacity in several African countries. In Angola, the company has signed up to develop 2,000 MW, 1,000 MW in Zambia and 500 MW in Ethiopia.

Financing green hydrogen

Masdar has obtained its first concession for the production of green hydrogen in Egypt. In this North African country, the UAE company has joined forces with Egypt’s Hassan Allam Utilities to develop 4 GW of renewable energy electrolysis capacity. The resulting green hydrogen will enable the production of other low-carbon compounds and fuels, including green ammonia for the decarbonisation of nitrogen fertilisers, sustainable aviation fuel and e-methanol for maritime transport.

Read also- TANZANIA: Tanesco joins forces with Masdar to produce 2 GW of clean energy

In this context, the partnership between Masdar and IFC aims at potential collaboration on bankability and structuring issues for renewable energy projects in Africa, as well as the establishment of a green hydrogen platform for emerging markets. “The partnership also covers the exploration of mechanisms to accelerate the adoption of distributed photovoltaic systems, and the development of new technologies and innovative business models in emerging markets in response to the evolving climate crisis,” says Masdar.

The IFC is expected to be instrumental in mobilising finance for its projects. The subsidiary of the World Bank Group is very active in the renewable energy sector in Africa, in particular through its “Scaling Solar” programme, which enables the construction of solar photovoltaic power stations within the framework of public-private partnerships (PPPs) in Africa. In Mozambique recently, the financial institution headed by Makhtar Diop signed a partnership with the public company Electricidade de Moçambique (EDM) for the construction of four solar photovoltaic power plants with a combined capacity of 50 MWp.

Jean Marie Takouleu